Everything you need to know about the Alternative Fuel Vehicle Refueling Property (§ 30C) Tax Credit in 2024

The Alternative Fuel Vehicle Refueling Property Tax Credit, also known as the “30C” tax credit or EV charging tax credit, has been around for quite a few years and is one of the primary federal incentives to help offset the cost of installing EV charging stations.

This tax credit has recently been expanded, and updated in ways that both increase its value and also more narrowly define what projects are eligible.

If you’re among those interested in applying, here’s what you need to know about the § 30C Alternative Fuel Vehicle Refueling Property Credit tax credit in 2024.

What is included in the 30C credit?

The 30C rebate is a national tax credit meant to expand access to alternative fueling or EV charging stations. Recent federal changes have extended the tax credit to cover projects installed through the end of 2032.

Eligible projects can receive up to $100,000 per item of property or 30% of the cost of the project.

In addition to the usual way of claiming the credit when filing one’s taxes, the credit can also be monetized in two other ways, depending on the type of entity:

- Tax-exempt entity: Can accept the tax credit as a direct cash payment from the IRS.

- For-profit entity: Can transfer (or sell) the credit amount to another taxpayer.

Eligibility requirements

The revised tax credit is intended to expand access to EV charging in underserved areas, defined as:

- A non-urban area (as defined in the latest census)

- A “low-income community,” meaning a census tract with a poverty rate of at least 20%

Additionally, to be eligible for the full 30% credit, a project must meet prevailing wage and apprenticeship standards.

The IRS has created this handy interactive map to determine whether a project location is eligible.

Per the Department of Labor, “A prevailing wage is the combination of the basic hourly wage rate and any fringe benefits rate, paid to workers in a specific classification of laborer or mechanic in the geographic area where construction, alteration, or repair is performed.”

Projects that do not meet these prevailing wage requirements will instead only be eligible for a rebate of 6%, not 30%.

How to apply & deadlines for the EV charging tax credit

To apply for this tax credit, you must complete IRS form 8911 and include it with your tax return. You can find instructions for how to complete the form here.

You can also read more about the tax credit on this info page from the IRS.

Qualifying projects may benefit from this credit between January 1, 2023 and December 31, 2032.

If you’re unsure of how to apply or would like more information or assistance, reach out to our team for help!

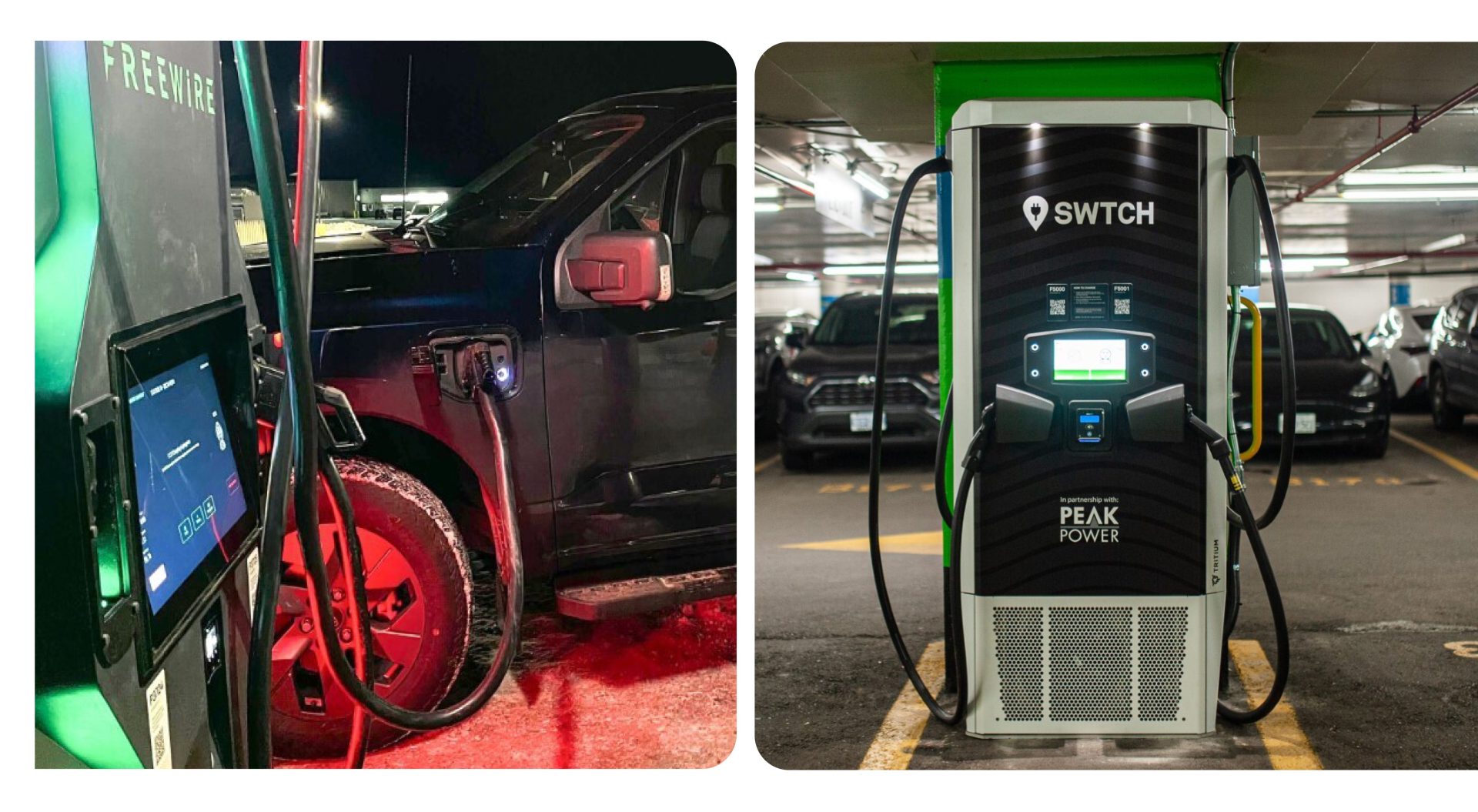

Who is SWTCH?

Whether it is apartment, condominium, affordable or market-rate housing, SWTCH is here to help. Through our turnkey EV charging solution, we’re here every step of the way; from system design, electrical sizing, incentive application support, all the way to installation and 24/7/365 support for you and your EV drivers.

At SWTCH, we leverage state-of-the-art technology to help building owners and operators deploy optimized multi-vehicle charging systems. SWTCH’s solution utilizes the building’s existing grid infrastructure to deploy a cost-effective charging system that works for your EV drivers today and smoothly scales to support the charging demand in the future. To learn more about SWTCH, check out our multifamily, workplace, and retail/public EV charging solutions.

We can also help you navigate the complexities of incentive applications and ensure your filing meets the high-quality standards of a successful bid. Get in touch today to learn how you can take advantage of this credit and opportunity to add EV charging to your property.